Companies consider M&A in order to increase value to the shareholders. This increase in shareholder value can only occur if the acquisition embodies synergies. Without the synergies the value of the entities before and after will be equal. With synergy effects the combined entity can benefit from improved sales and operations, reduction in cost and removal of redundant assets. Needless to say, some of these synergies could have some additional costs.

How to determine value creation that rides on synergies

These are some of the areas where synergies may exist:

- New revenue channels

- Cost reductions

- Increased operating cash flow

- Improved managerial decision making

- Liquidation of redundant assets

Because of these synergies, companies may pay a premium over the market price. When two companies merge, there may be some overlap in operations, target customers served by both entities, or new potential customers that may be underserved. Synergies focus on the new revenue opportunities and cost reductions in assets and redundant workforce to offset the initial decline in revenue.

Some of the most common synergies are improved marketing tactics, branding and more advanced technologies as well as new or more impactful distribution channels. Some of the benefits could be related to taxation. Main synergies in an acquisition must be known in pre-due diligence stage. The objective of due diligence is to:

- Identify any risks and issues that may hinder realizing these synergies post acquisition

- Determine the probability and likeliness of realizing the synergies

- Identify any new cost and revenue synergies that were not foreseen prior to due diligence

- Any transactional matters that could affect the Synergies; taxation, IP and technology agreements, customer agreements, etc.

- Any mis-representation or mis-calculation that could have impact on synergies

It is important that the due diligence team scrutinizes areas of due diligence that are directly tied to the synergies. Many times realization my require third party consensus or additional costs. Some more complicated cases may tie to the future performance of the target company.

Note that there may be implicit or hidden costs or investments that the buyer must make in order to create a catalyst for the synergies. Many of these hidden costs could affect the pricing and valuation of the target in the transaction. Overlooking these costs could potentially destroy the values in an acquisition rather than creating them.

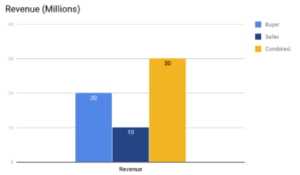

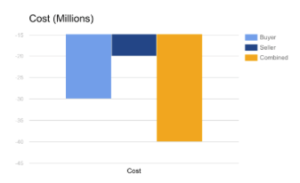

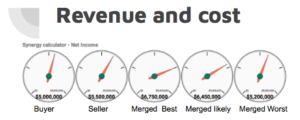

Let’s go through an example here:

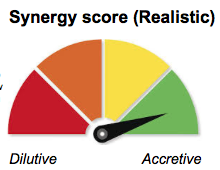

Refer to the synergy meter for a simple tool that helps you play out different scenarios for your next acquisition. Additionally, this page will provide industry data that will help you compare your scenario with industry average.