Decision theory, as described in Wikipedia, is an interdisciplinary topic studied by economists, statisticians, psychologists, biologists, political and other social scientists, philosophers, and computer scientists. This topic is the study and reasoning about underlying choices. Combined with uncertainty of choices , decision theory becomes a more interesting and complex topic and adjacent to scenario based planning.

In the course of our day to day activities we make many decisions of varying complexities. Some of these can be important and difficult. When the stakes are high, it is important to formulate the process of decision making in a manner that can be clearly communicated and provide a quantitative measure to evaluate the choices.

The most important part of formulating the decision making process is to identify the criteria to be able to make subjective decisions as accurately as possible. As the number of choices increases this process become more and more complex. The uncertainty of the criteria further aggravates this process.

The most basic approach to model the decision making process is a weighted decision matrix or WMD. WMD is a simple tool that helps manage the complexity of large set of choices and evaluate the alternatives.

In mergers and acquisitions, a strategic buyer is faced with a number of choices at different stages of the process. Once an investment thesis is in place, matching targets are identified and assessed against the investment strategy and other criteria having to do with the capability and concerns of the buyer as well as the financial impact. As the number of targets increases, this process can be overwhelming, prone to errors, and missed opportunities.

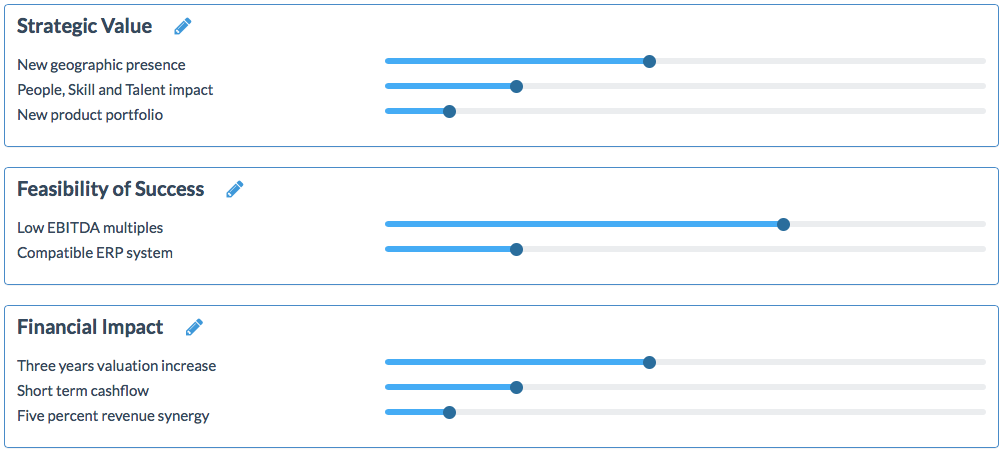

A framework that provides a quantitative measure to evaluate targets can make a huge difference in ensuring that poor targets are identified early and high potential targets get the attention they require. This framework must capture the following dimensions:

- Strategic fitness

- Feasibility of success

- Financial impact

Each of these dimensions are further broken down into a few value drivers. Value drivers are the criteria that will be scored and provide a measuring stick to compare different targets. Geographic expansion, new product portfolio, cross-selling, and up-selling are some of the common value drivers. The importance of each value driver along with its subjective score provides a communication tool as well as a quantitative measure very useful in managing an M&A pipeline.